Our San Diego Home Insurance Diaries

Our San Diego Home Insurance Diaries

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Coverage Program

Importance of Affordable Home Insurance Policy

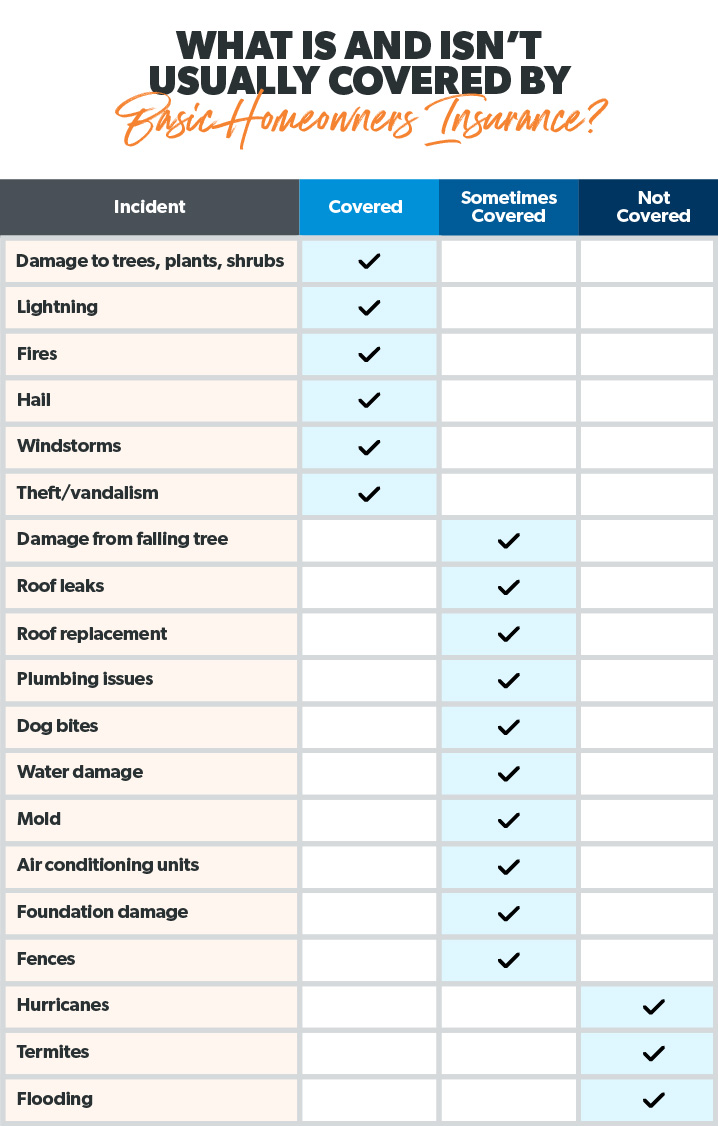

Protecting affordable home insurance policy is vital for securing one's property and monetary wellness. Home insurance provides defense versus numerous risks such as fire, theft, all-natural disasters, and individual responsibility. By having a detailed insurance policy plan in area, homeowners can feel confident that their most significant investment is secured in case of unpredicted circumstances.

Budget-friendly home insurance coverage not just offers financial protection yet additionally provides comfort (San Diego Home Insurance). In the face of increasing home values and building and construction prices, having an affordable insurance coverage policy makes certain that home owners can conveniently restore or fix their homes without dealing with substantial economic problems

Furthermore, cost effective home insurance policy can likewise cover personal items within the home, using compensation for things damaged or taken. This insurance coverage extends beyond the physical framework of your house, securing the materials that make a house a home.

Protection Options and Limits

When it involves protection limits, it's important to comprehend the optimum amount your plan will certainly pay for each and every sort of coverage. These limits can vary depending upon the policy and insurance provider, so it's necessary to examine them thoroughly to guarantee you have adequate defense for your home and possessions. By understanding the coverage options and limits of your home insurance coverage, you can make informed decisions to protect your home and enjoyed ones successfully.

Variables Influencing Insurance Coverage Expenses

A number of variables dramatically affect the expenses of home insurance coverage policies. The place of your home plays a crucial role in identifying the insurance coverage costs.

In addition, the sort of coverage you pick straight impacts the expense of your insurance plan. Choosing additional insurance coverage choices such as flooding insurance or check it out earthquake insurance coverage will certainly enhance your costs. Similarly, picking greater insurance coverage restrictions will certainly lead to higher prices. Your deductible quantity can also affect your insurance coverage costs. A higher deductible typically means reduced costs, yet you will have to pay more his comment is here out of pocket in the event of a case.

In addition, your credit history, asserts history, and the insurer you choose can all influence the price of your home insurance plan. By taking into consideration these variables, you can make educated choices to aid manage your insurance policy sets you back successfully.

Contrasting Quotes and Providers

Along with contrasting quotes, it is vital to examine the credibility and economic security of the insurance service providers. Seek consumer testimonials, ratings from independent companies, and any history of problems or regulatory actions. A trusted insurance provider should have an excellent performance history of without delay processing cases and providing superb client solution.

Additionally, think about the specific protection attributes used by each supplier. Some insurance companies may offer additional benefits such as identity burglary security, devices break down coverage, or protection for high-value items. By carefully contrasting quotes and carriers, you can make a notified decision and select the home insurance policy plan that best satisfies your requirements.

Tips for Conserving on Home Insurance Coverage

After completely comparing companies and quotes to discover the most suitable coverage for your needs and budget, it is prudent to discover reliable approaches for saving on home insurance policy. Many insurance coverage firms offer discounts if you acquire multiple plans from them, such as combining your home and auto insurance policy. On a regular basis assessing and upgrading your policy to reflect any modifications in your home or conditions can ensure you are not paying for coverage you no longer requirement, helping you save money on your home insurance costs.

Conclusion

To conclude, protecting your home and enjoyed ones with inexpensive home insurance policy is essential. Comprehending insurance coverage limitations, options, i was reading this and elements influencing insurance coverage prices can help you make informed decisions. By comparing quotes and service providers, you can locate the very best plan that fits your needs and budget. Carrying out pointers for conserving on home insurance can likewise assist you safeguard the necessary protection for your home without damaging the financial institution.

By untangling the intricacies of home insurance coverage strategies and exploring sensible methods for securing economical coverage, you can ensure that your home and enjoyed ones are well-protected.

Home insurance coverage policies normally supply several protection choices to shield your home and valuables - San Diego Home Insurance. By understanding the coverage options and limitations of your home insurance coverage plan, you can make informed decisions to safeguard your home and loved ones effectively

Routinely evaluating and upgrading your plan to mirror any kind of changes in your home or scenarios can guarantee you are not paying for coverage you no longer requirement, assisting you save money on your home insurance coverage premiums.

In final thought, protecting your home and loved ones with budget-friendly home insurance policy is important.

Report this page